Why it's ok to have frequent crashes and slow recoveries in the Stock Market

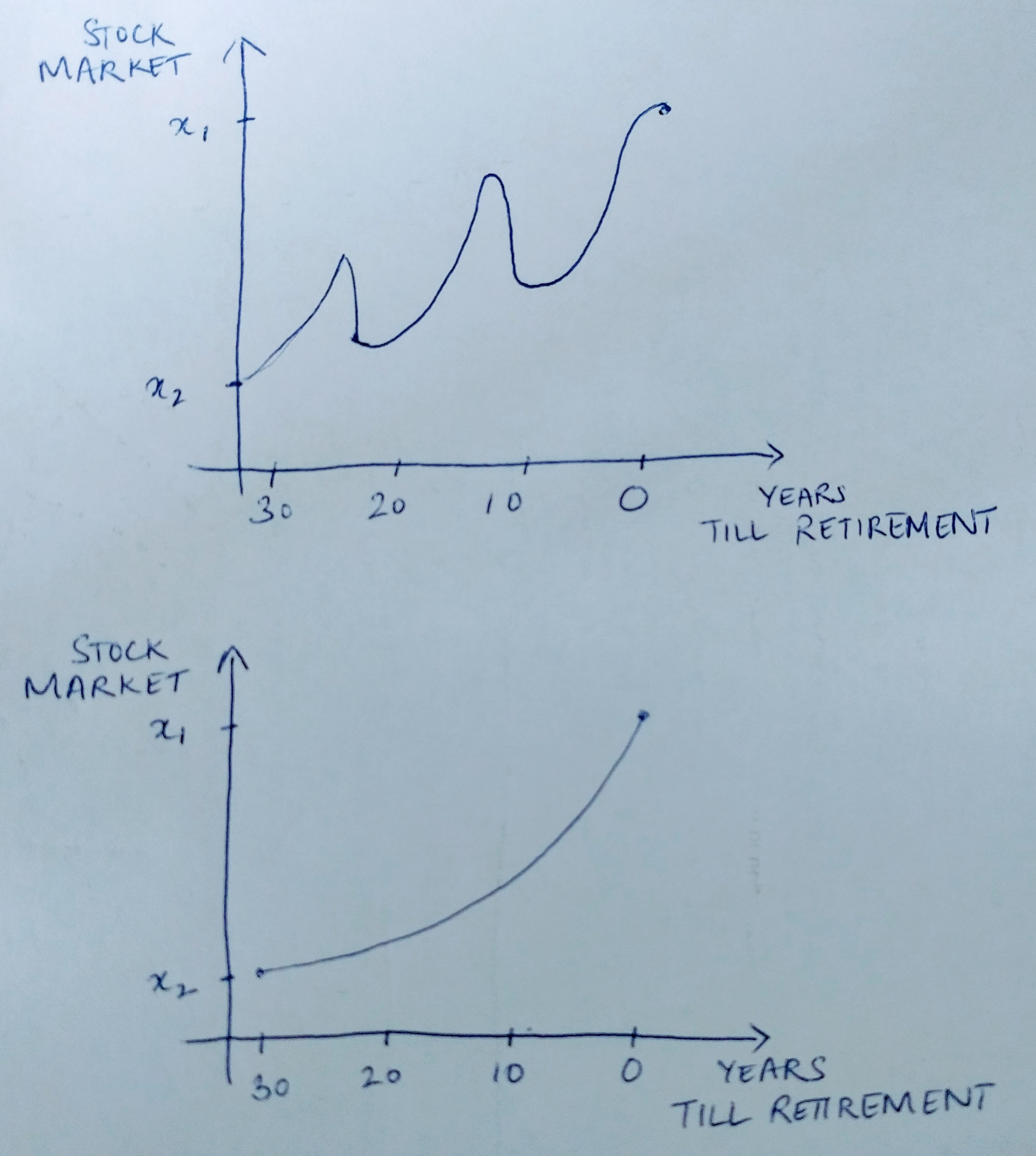

Here are two contrived and hypothetical scenarios in the life time of the Stock Market.

The two scenarios above present two possible ways a stock market can grow in a 30-year time period. In each case, it grows from x2 to x1. In scenario B, it takes a very smooth coarse whereas in scenario A, it takes a very choppy and volatile coarse. Scenario B definitely looks more appealing and scenario A looks unsettling. However, as someone who has 20+ years of investing ahead of them, you should strongly prefer scenario A.

The underlying assumption is you are always buying. Since you buy through the dips (aka dollar cost averaging), you are better off at the end of 30 years in scenario A compared to scenario B. Volatility is your biggest friend while investing long term in the stock market. It is literally what moves the market. The market going down is simply you getting a better deal. But, it does not necessarily mean you buy more. How much of your holding you buy or sell depends on your personal life goals rather than the goals of the market.

Money that you need within the next 6 months should not be in the market (more discussion). If the money you’ve invested in not needed within the next 6 months, why bother with the daily squiggles, zigs and zags?

Money that you invest in the Stock Market is in many ways like the bricks you use to build your home. You put them there hoping never to have to take them out. You expect for those bricks to keep giving you a return forever. At some point, we will discuss how to strive for that setup where you never have to sell any of your holdings (like the great Warren Buffett), but of course that takes immense amounts of discipline and hardwork.